Mobile App Monetisation Strategies for Australian Developers

Building a great mobile app is only half the challenge. Turning that app into a sustainable business requires a carefully considered monetisation strategy. For Australian developers, the local market presents unique characteristics that influence which strategies work best.

Australia has one of the highest smartphone penetration rates globally, with over 80 percent of the population owning a smartphone. Australian users tend to spend more on apps than the global average, making it a lucrative market for developers who get their monetisation right.

Understanding the Australian App Market

Before diving into specific strategies, let us look at the numbers that matter.

According to App Annie’s 2020 data, Australian consumer spending on mobile apps reached approximately AUD 3.4 billion. The App Store continues to generate higher per-user revenue than Google Play, though Android holds a larger market share in Australia at roughly 53 percent.

Key Australian market characteristics:

- High willingness to pay: Australians are accustomed to paying for quality digital services

- Subscription fatigue is real: With Netflix, Spotify, and numerous other subscriptions, users are selective about recurring charges

- Privacy consciousness is growing: Australians are increasingly wary of ad-funded models that rely on data collection

- GST applies: The 10 percent Goods and Services Tax applies to digital products sold in Australia, which both Apple and Google handle for you on their platforms

Strategy 1: Freemium with

In-App Purchases

In-App Purchases

The freemium model offers a free base app with optional premium features or content available through in-app purchases (IAP). This is the most common monetisation strategy on both app stores.

How It Works

Users download and use your app for free. Core functionality is available without payment, but advanced features, additional content, or convenience items are locked behind one-time or consumable purchases.

Best Practices for the Australian Market

Be generous with the free tier. Australian users are savvy and will leave negative reviews if the free version feels crippled. Give enough value that users genuinely enjoy the app before asking for money.

Price in AUD. Apple and Google both support Australian Dollar pricing tiers. Use them. Displaying prices in USD creates friction and uncertainty about the final charge.

Offer a compelling upgrade path. The jump from free to paid should feel natural, not forced. Users should want to pay because they love the app, not because they are frustrated by limitations.

Example pricing tiers that work well in Australia:

- Entry IAP: AUD 1.49 to AUD 2.99 (impulse purchase territory)

- Mid-tier feature unlock: AUD 4.99 to AUD 9.99

- Full premium unlock: AUD 14.99 to AUD 29.99

Revenue Expectations

Conversion rates from free to paid typically range from 2 to 5 percent for well-optimised apps. If your app has 10,000 monthly active users with a 3 percent conversion rate and an average purchase of AUD 4.99, that is roughly AUD 1,497 per month before Apple or Google’s commission.

Strategy 2: S

ubscription Model

ubscription Model

Subscriptions generate recurring revenue and are increasingly favoured by both app stores. Apple reduced its commission on subscriptions from 30 percent to 15 percent after the first year of a subscriber’s tenure, making this model more attractive.

When Subscriptions Make Sense

Subscriptions work best when your app provides ongoing value that justifies recurring payment:

- Content apps (news, media, education)

- Productivity tools with cloud sync

- Health and fitness tracking

- Professional tools and services

Pricing for Australia

Monthly subscription prices that perform well in the Australian market:

- Budget tier: AUD 2.99 to AUD 4.99 per month

- Standard tier: AUD 7.99 to AUD 12.99 per month

- Premium tier: AUD 14.99 to AUD 24.99 per month

Annual pricing should offer a meaningful discount, typically 15 to 30 percent compared to monthly billing. This improves retention and provides more predictable revenue.

Reducing Churn

Churn is the subscription model’s biggest challenge. Strategies to reduce it:

- Deliver consistent value. Regular content updates, new features, and improvements justify the ongoing cost.

- Use grace periods. Both iOS and Android support billing grace periods for failed payments. Enable them.

- Win back lapsed subscribers. Offer a discounted return rate to users who cancel.

- Implement free trials. A 7-day or 14-day free trial lets users experience the full product before committing. Apple now supports offer codes for promotional trials.

Strategy 3: Ad

vertising Revenue

vertising Revenue

Ad-supported apps are free to use, with revenue generated through displayed advertisements. This model works for apps with high engagement and large user bases.

Ad Formats

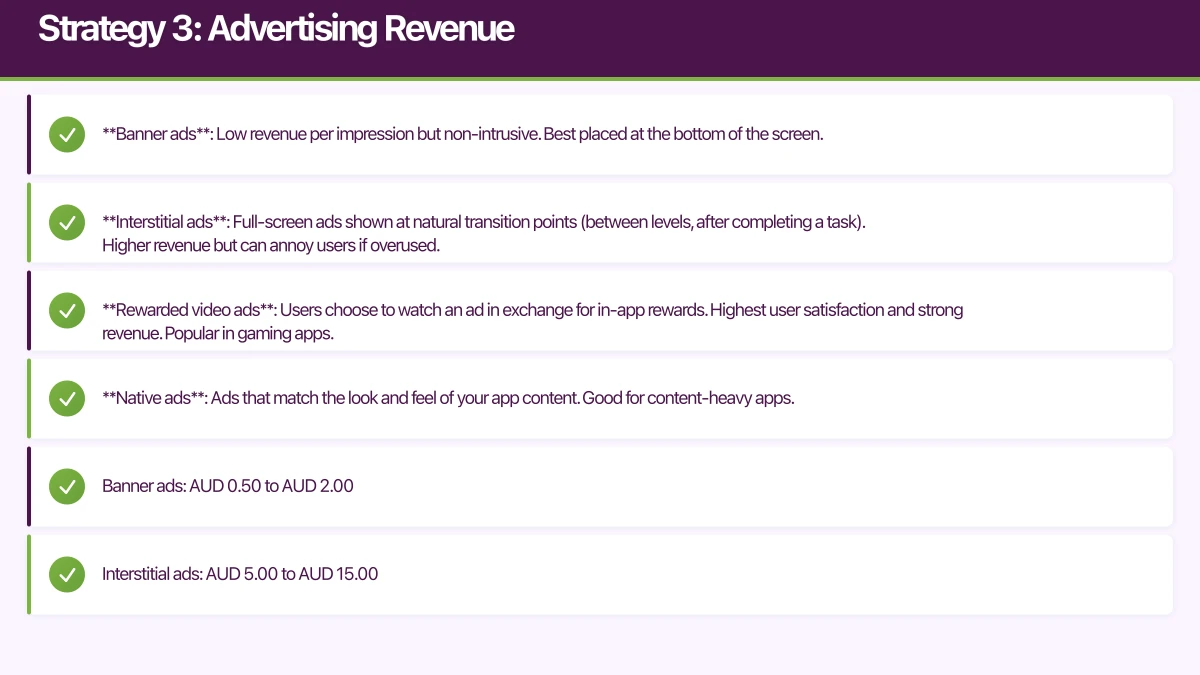

- Banner ads: Low revenue per impression but non-intrusive. Best placed at the bottom of the screen.

- Interstitial ads: Full-screen ads shown at natural transition points (between levels, after completing a task). Higher revenue but can annoy users if overused.

- Rewarded video ads: Users choose to watch an ad in exchange for in-app rewards. Highest user satisfaction and strong revenue. Popular in gaming apps.

- Native ads: Ads that match the look and feel of your app content. Good for content-heavy apps.

Revenue Expectations

Ad revenue varies dramatically by geography, category, and implementation. For Australian users, typical eCPMs (effective cost per thousand impressions):

- Banner ads: AUD 0.50 to AUD 2.00

- Interstitial ads: AUD 5.00 to AUD 15.00

- Rewarded video: AUD 10.00 to AUD 30.00

To generate meaningful revenue from ads alone, you need substantial scale. An app with 50,000 daily active users showing an average of 3 interstitial ads per session at an AUD 8 eCPM generates roughly AUD 1,200 per day.

Ad Networks for Australian Developers

- Google AdMob: The dominant player. Good fill rates for Australian traffic.

- Meta Audience Network: Strong performance, especially for social and entertainment apps.

- Unity Ads: Excellent for games. Good Australian fill rates.

- AppLovin: Growing network with competitive eCPMs.

Consider using mediation (AdMob Mediation or AppLovin MAX) to serve ads from multiple networks and maximise revenue.

Privacy Considerations

Apple’s App Tracking Transparency (ATT) framework, introduced with iOS 14.5, requires apps to ask permission before tracking users across other apps and websites. This significantly impacts ad targeting and revenue on iOS. Expect lower eCPMs for users who opt out of tracking.

For Australian developers, this means ad-only monetisation on iOS is becoming riskier. Diversifying your revenue streams is advisable.

Strategy 4: Paid Apps

Charging upfront for your app is the simplest model but the hardest to execute in 2021. Users expect to try before they buy, and the app stores are saturated with free alternatives.

When Paid Works

Paid apps still work in specific niches:

- Professional tools with clear value propositions (e.g., pro photography apps)

- Niche utility apps with no free alternatives

- Apps with strong brand recognition or press coverage

Pricing

For paid apps targeting Australian users:

- Utility apps: AUD 1.49 to AUD 4.99

- Productivity apps: AUD 4.99 to AUD 14.99

- Professional tools: AUD 14.99 to AUD 49.99

The biggest risk with paid apps is the discovery problem. Without a free version, you cannot leverage viral growth or word-of-mouth as effectively.

Strategy 5: Hybrid Models

The most successful apps often combine multiple monetisation strategies:

- Freemium plus ads: Free tier shows ads, premium tier removes them. This gives users a clear incentive to upgrade while generating revenue from non-paying users.

- Subscription plus IAP: Subscription unlocks core premium features, while IAP provides additional content or customisation. Be careful not to double-charge users.

- Paid plus IAP: Rare but effective for premium games. Users pay upfront for the core experience, with optional expansions available as IAP.

Tax and Legal Considerations for Australian Developers

GST

If you sell digital products through the app stores, Apple and Google handle GST collection and remittance for sales to Australian consumers. However, you should still consult with an Australian tax accountant to ensure your business structure is appropriate.

ABN Requirement

If your app generates income, you will need an Australian Business Number (ABN). You can register as a sole trader or set up a company structure depending on your circumstances.

Apple and Google Commissions

Both Apple and Google take a 30 percent commission on in-app purchases and paid app sales. Apple’s App Store Small Business Program reduces this to 15 percent for developers earning under USD 1 million per year. Google announced a similar program reducing its commission to 15 percent for the first USD 1 million in annual revenue.

For most Australian indie developers and small studios, the 15 percent rate applies. This significantly improves unit economics.

Choosing Your Strategy

Consider these factors when selecting your monetisation approach:

- Your app category: Games typically monetise through IAP and ads. Productivity apps suit subscriptions. Niche tools can justify upfront pricing.

- Your target users: Business users are more willing to pay upfront or subscribe. Consumer apps often need a free tier to achieve scale.

- Your growth goals: If rapid user acquisition is the priority, free plus ads or freemium models lower the barrier to entry.

- Your content roadmap: If you plan regular updates and new content, subscriptions align incentives. If the app is feature-complete, one-time purchases make more sense.

- Your runway: Subscriptions take time to build but provide predictable recurring revenue. Ads and IAP can generate revenue faster but are less predictable.

Measuring Success

Regardless of your chosen strategy, track these metrics:

- ARPU (Average Revenue Per User): Total revenue divided by total users. Target varies by category.

- LTV (Lifetime Value): The total revenue you expect from a user over their lifetime. Essential for determining how much you can spend on acquisition.

- Conversion rate: The percentage of free users who become paying users.

- Churn rate: For subscriptions, the percentage of subscribers who cancel each month.

- eCPM: For ad-supported apps, the effective revenue per thousand impressions.

Getting Started

If you are launching a new app in Australia in 2021, our recommendation is to start with a freemium model. Offer genuine value for free, identify the features your most engaged users love, and gate those behind a reasonable price point.

Build your analytics from day one so you understand user behaviour before making monetisation decisions. Tools like Firebase Analytics, Mixpanel, or Amplitude provide the insights you need.

At eawesome, we help Australian startups and developers design monetisation strategies that balance user experience with business sustainability. The right approach depends on your specific app, audience, and goals.